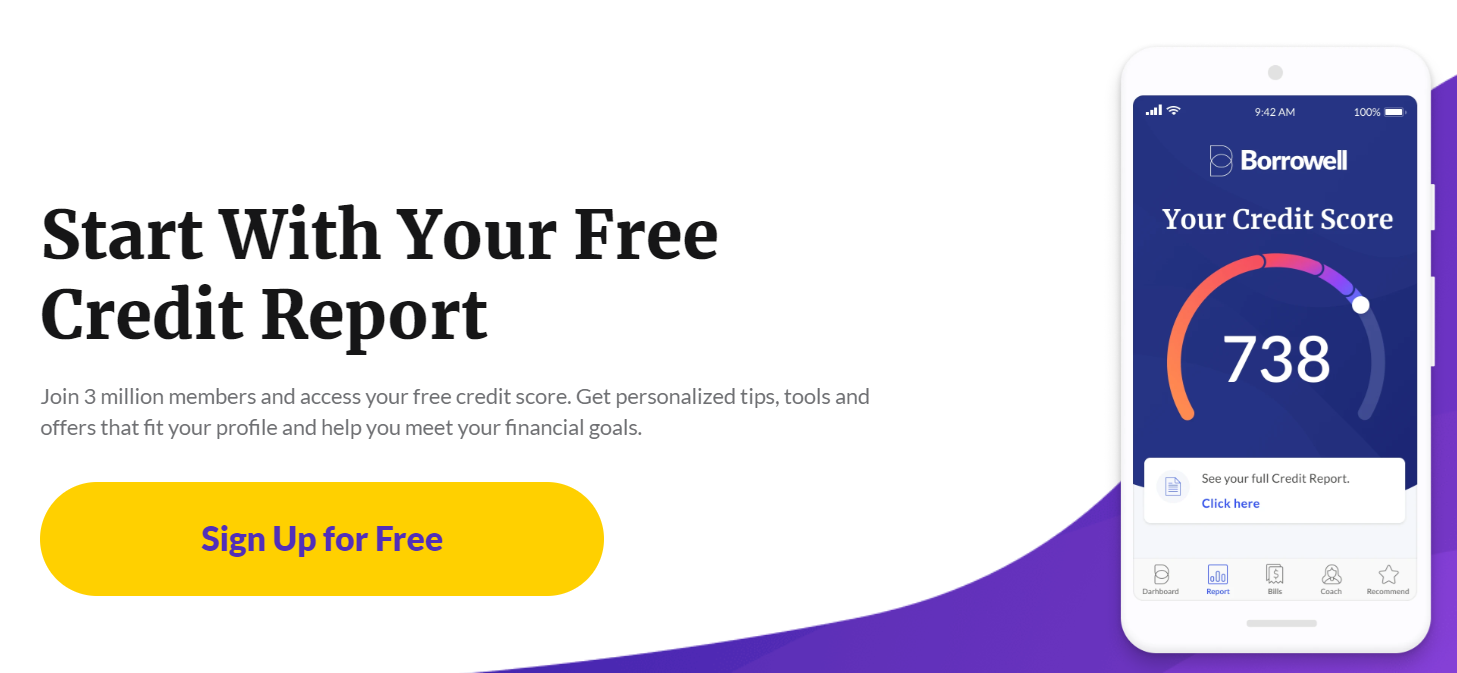

Borrowell launched in 2014 as a debt refinancing marketplace and personal loan provider. Since then, the company has expanded to offer Canadians free access to their credit scores through a partnership with Equifax.

Those who choose to sign up for Borrowell’s free services will also have access to online marketplaces where they can compare and apply for credit cards, personal loans, mortgages, insurance, and banking products from Borrowell’s partners.

In 2021, Borrowell acquired Refresh Financial, allowing the company to offer secured credit cards and credit-building loans. Borrowell claims to have over 3 million members.

Who is Borrowell best suited for?

Canadians interested in monitoring their credit and generating reports online.

Borrowell may also be useful for younger Canadians or newcomers to Canada who are still in the early stages of building their credit profile. Although there is a fee, Borrowell offers credit-building products that help you build a positive credit history without taking on debt.

Finally, Borrowell may be useful for existing members interested in purchasing financial products such as credit cards, personal loans, and insurance.

Is Borrowell safe to use?

Borrowell is a reputable Canadian company based in Toronto, Ontario. Borrowell is not a credit reporting agency, but can provide free access to credit scores and credit reports through its partnership with one of Canada’s two credit reporting agencies, Equifax. The other Canadian credit reporting agency is TransUnion.

On its website, Borrowell states that the company invests in fraud detection and protection technologies and uses “strict security procedures” to ensure the safety of any financial information you may share with it.

Borrowell’s website also states that the company “does not disclose, trade, rent, sell, or otherwise transfer your personal information without your consent.” While Borrowell does offer some free services, it is a company whose primary purpose is to get people to order financial products through its marketplaces.

Costs to Use Borrowell

There is no charge to use Borrowell’s free services. This includes checking your Equifax credit score, obtaining your Equifax credit report, and tracking your bills.

While Borrowell offers some free services, it is a business that generates revenue by incentivizing people to purchase and select financial products offered on its marketplaces. If you select a product offered by a Borrowell partner, Borrowell will receive a referral fee.

Borrowell Rent Advantage

In July 2022, Borrowell launched a new product called Rent Advantage[1]. This program is available to Borrowell members who are willing to pay an $8 per month fee. It aims to ensure that rent payments are reported on time to Equifax Canada. Rent Advantage is billed as a debt-free way for renters to build their credit and history.

In June 2024, Borrowell introduced a new feature that allows members to report up to two years of past rent payments to Equifax at once. There is a one-time fee of $59 for this rental reporting service. Borrowell says it will refund this fee if users do not see an improvement in their credit score once the payments are added to their Equifax Canada credit report.[2]

To participate in Rent Advantage or report past rent payments, you must provide details of your rental agreement and proof of rent payment. You may also need to link the bank account or credit card you used to pay the rent. No landlord permission is required to use either service.

Borrowell FAQ

Is Borrowell’s credit score accurate?

Borrowell shows users their Equifax Risk Score 2.0. This credit score is commonly used in Canada, but it is not the only score considered when applying for a loan or other financial product.

+ There are no comments

Add yours